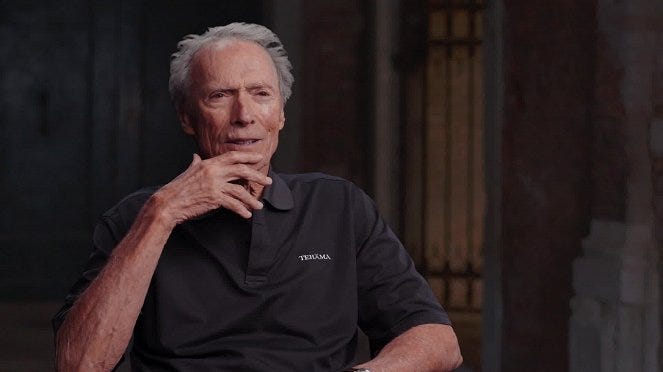

Even People on the Liberal Side Are Starting to Worry About Going off a Fiscal Cliff. -Clint Eastwood

Clint and I are about the same age, or close to it, but there’s something about celebrity that demands attention. I’m merely one of those people who’s starting to worry, but Clint has gravitas.

But I know when the crisis began, who was responsible, and how to avoid the fall. I wish I was celebrity enough to garner some attention.

It began in the late fifties.

In 1954, when I was a young sprite of nineteen, and on the cusp of beginning my business career, the top rate of income tax was 92%. That was a graduated tax, so only the really wealthy paid a portion of their tax at that rate. The Fed still borrowed a few bucks here and there, but it was in the very low billions and declining, $4 billion in 1952 and a half billion in 1953.

The reason we even had that, was the leftover costs of WWII and the Marshall Plan but, essentially, we ran the government on present-day income taxes. Business was booming, we were an industrial powerhouse (due mostly to having the only undamaged industries) and a new millionaire class was sprouting like weeds in a garden. I know that for a fact, because I was a landscape architect, designing and planting their gardens.

Then various presidents found it popular to reduce taxes, Milton Friedman’s economic policies became the new truth, and Ronnie Reagan smooth-talked the nation into ‘trickle-down economics,’ where he claimed tax cuts would float all boats.

Revenues sank, deficits soared, and swamped any boat still afloat.

By the time Reagan came into office, prior presidents had lowered the top rate from 92% to 70% and by the time Reagan left, eight years later, the graduated tax was mostly gone, and a 38% top rate came nowhere near paying the bills.

As of March 6, 2025, the U.S. national debt stood at approximately $36.56 trillion, and the interest alone sucked up $311 billion. Wrap your mind around this: In 75 years we had been suckered into going from a total debt of $4 billion, to mere interest on that debt, totaling $311 billion.

The Congressional Budget Office predicts that debt to climb to $50 trillion in ten years. The interest alone will approach $1.5 trillion, and the combination will be nearly twice the annual GDP.

Those are numbers no nation can survive.

All else aside, Clint and I agree that this significant increase over the past decades results from a combination of factors.

1) Looking back over the past four presidencies, George W. Bush increased our debt by $5 trillion across two terms. Barack Obama by $9 trillion across his two terms, and the Orange Man by $8 trillion in a single term.

2) Grover Norquist, the president of Americans for Tax Reform, and a man never elected to any political office, played a significant role in popularizing the "No New Tax Pledge" among Republicans, threatening them with financing a competitor in the next election if they failed to comply. Indeed, he carried out that threat so completely that today, forty years after introducing the pledge, a significant majority of Republicans remain signatory.

3) Citizens United v. FEC (2010) was a U.S. Supreme Court case where the Court ruled that corporations and unions could spend unlimited amounts of money on independent political ads viewing that such spending is protected free speech. The decision led to the creation of Super PACs, which can raise and spend unlimited funds but cannot coordinate directly with candidates or campaigns.

Thus, with no new taxes, the last time Clint and I talked, we agreed that deficits are skyrocketing, and unsustainable. So, what to do?

Short of bankruptcy, we need to get back to our old ways.

Rather than simply taking it from the rich, we need to get back to the graduated tax, and its magical 92 percent. If the U.S. adopted a 92% top marginal tax rate for high earners in today’s economy, it could potentially generate over $2 trillion annually in additional revenue, based on estimates for the top 1% of earners and their taxable income.

It's a start.

Closing offshore tax havens would help as well. Americans need to become more participatory, in what threatens to be an existentialist threat. Those who fail to put their shoulder to the wheel, in my opinion, deserve to have their citizenship revoked. Turn in your passport or pay your share.

Then, re-invent and simplify the tax code, getting rid of all tax exemptions, each and all of which were written to help a specific applicant. No more specifics, we’re all in the same boat now…the one Ronnie said would float us all.

Also, introduce a one half of one percent tax on all stock exchange trades. That would accomplish two things: 1) bring in approximately $300 billion in revenue, and (perhaps more importantly) stabilize the market by greatly reducing ‘flash trades.’ Flash trades bring nothing of value to the market, merely skimming small profits, yet they have several times created near disasters when computers fought one another over trades. On May 6, 2010, a large sell order, combined with the automated high-frequency trading algorithms, led to a cascade of automatic sales, causing an extreme drop in stock prices. The (SEC) and (CFTC) conducted an investigation and found that the crash was mainly caused by the interaction of large sell orders and high-frequency trading algorithms, which amplified the market's volatility.

And finally, rescind Grover Norquist’s no new tax pledge, free up those captive Grover Norquist Republican scardy-cats, and send them back to Congress to work on the forgotten bi-partisanship of better times.

We once knew how to run government in the United States.

Maybe we can relearn the process.

If not, it’s over, and our experiment in republican democracy is lost to the world.