HSBC is Not and Never Was Too Big to Prosecute

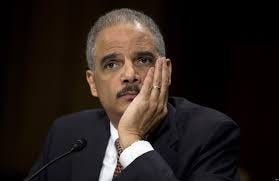

By now we all know the Eric Holder statement that HSBC (Hongkong and Shanghai Banking Corporation) was just too large to prosecute without the financial world falling apart. Under oath, he told the Senate Judiciary Committee just that. That story is four months old now and perhaps the news-cycle is busy enough with other matters for my opinion to be heard.

Holder is wrong for a bunch of reasons, but his major wrong is that HSBC would have purred along just fine if it’s top fifteen executives had been indicted and, after ‘due process and a jury of their peers,’ found themselves stamping out license plates for twenty or thirty years.

Case in point:

Ann Almeida, Group Head of Human Resources and Corporate Sustainability

Samir Assaf, Chief Executive, Global Banking and Markets

Irene Dorner, President and Chief Executive Officer, HSBC USA

Pam Kaur, Group Head of Internal Audit

Alan Keir, Global Head of Commercial Banking

Stuart Levey, Chief Legal Officer

Antonio Losada, Chief Executive of Latin America and the Caribbean

Marc Moses, Group Chief Risk Officer

Sean O’Sullivan, Group Chief Operating Officer

Brian Robertson, Chief Executive, HSBC Bank plc

Peter Wong, Chief Executive, The Hongkong and Shanghai Banking Corporation

Are we up to fifteen yet? Not quite, but twelve will serve for the argument. I have no idea if any of these top execs are or were guilty of indictable banking offenses, but the HSBC website touts them as senior management, so they’ll have to do as placeholders for the argument. There is not one among them that, if run down by a tram on the way to work, is irreplaceable. Every single member of any large firm’s management has a #2 in the wings, well skilled to take over responsibility. So, what’s my point?

My point is that we’ve been sold a bill of goods, told to hold our noses and swallow. Worse yet, we’ve done just that. HSBC admitted to a string of criminal offenses that would send any ordinary citizen to prison, probably for life and struck a deal with the Department of Justice that admitted no wrongdoing and absorbed a fine in the deal. A rather large fine, about which the DOJ crowed from the chicken-coop—amounting to seven weeks profit. Seven weeks and a walk. Seven weeks and no one goes to jail, nor does anyone lose their job unless HSBC chooses to fire them.

Now, why does it matter? It matters for several reasons, the first of which is that our entire process of punishable offense suffers when justice is seen to target the small and give the big guys and girls a walk. Respect for law—all law, from running a stop sign to committing or abetting murder—has its basis in equity. If a hundred-dollar dealer goes to prison for twenty years and a firm abetting thousands of murders by laundering and secretively hiding from authorities the money that sustains drug-lords and terrorists takes a walk, we lose faith in the law itself.

Secondly, we encourage the very thing we meant to discourage—repeated offense charged off as ‘business expense.’ Bank after bank, Wall Street firm after Wall Street firm has made a revolving door of criminal offense and the continuation of business as usual, shrugging off the fines and increasing profits. Were executives of these criminal organizations (there is no other word for them) sent off to prison terms, as are private individuals, they would change their ways and continue to exist as large, honest, highly profitable organizations.

Examples are legion, but the current poster-child for grinning from the top is Jamie Dimon, Chairman, President and CEO of JPMorgan Chase, one of the Big Four banks in America. According to the Wall Street Journal, the Federal Energy Regulatory Commission (FERC) will fine Chase "close to $1 billion" for manipulating energy prices in Enron-esque fashion in Michigan and California.[1]

A one-time unfortunate lapse? Hardly. In (very) recent times and under Dimon’s leadership, Matt Taibbi discloses[2] that JP Morgan Chase settled numerous fraud and criminal charges with no admission of guilt and no indictments. Dimon, by the way, was named CEO of the Year in 2011 and banked a $23 million pay package for fiscal year 2011, more than any other bank CEO in the United States.[3]