Nationalizing Boeing May be Its Best Way Out

It’s not a pretty picture, but the decline of Boeing from Bill Boeing’s leadership is a bastard child born out of too many bad choices. Bill was an engineering-oriented mastermind, and aircraft are basically engineered vehicles that fly. When they fail, you don’t just pull over to he side of the road and call a tow-truck.

Boeing management forgot that, just as General Electric did a decade earlier under the wunderkind vision of CEO Jack Welch, who drove the company so far into the ground that it became unrecognizable. I make the comparison, because GE was an engineering firm that chased financial goals, and there are parallels.

Lesson: Go home with the lady you brought to the dance.

Many argue that Boeing’s 1997 merger with McDonnell Douglas marked the beginning of a long slide into unprecedented obscurity. The merger promised to bolster Boeing's dominance in commercial aircraft while significantly expanding its military and defense business through McDonnell Douglas's portfolio. What came of that was a conglomerate with no clear vision and competing management. Boeing’s expansion quite obviously weakened McDonnell Douglas's grip in military-defense, and McDonnel Douglas’s profit motivations weakened Boeing’s focus on engineering excellence.

Mergers and acquisitions are supposed to strengthen the participants, but history shows they often stumble over diverse management goals. This merger was a classic example that set Boeing on a course that Bill Boeing would never have allowed.

Boeing increasingly prioritized shareholder value, stock buybacks, and executive bonuses over long-term investment in safety, quality, and innovation.

And the engineers felt the wind blowing in an unfamiliar direction. For the first time, their CEO wasn’t an engineer. Boeing increasingly relied on outsourcing major components globally, which saved money, but led to serious delays, cost overruns, and quality control issues. Add loss of institutional knowledge. Reliance on suppliers eroded Boeing’s in-house expertise, as well as control over production. Along with that, came a loss of Institutional Knowledge. Outsourcing eroded Boeing’s in-house expertise and labor conflicts and cost-cutting harmed morale and quality, leading to strikes and wage disputes.

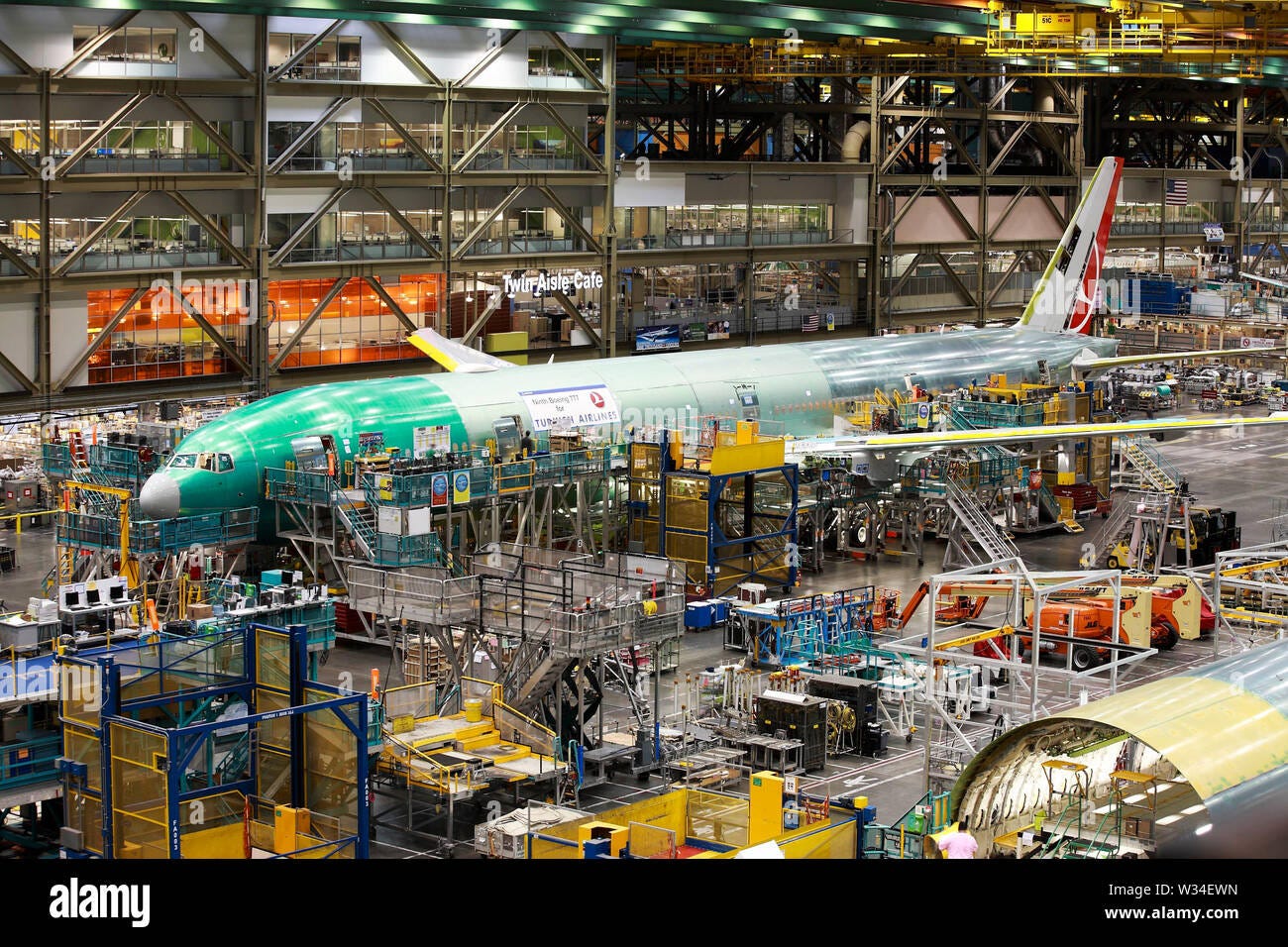

Boeing’s manufacturing facility at Everett, Washington is the largest such building in the world under one roof.

Boeing’s decline is largely attributed to a cultural shift from engineering excellence to financial engineering, compounded by failures in safety oversight, leadership instability, and erosion of internal quality controls. Restoring trust will likely require deep structural and cultural reforms, with little time and few financial resources to weather the storm.

And now, the Orange Man’s tariff policies are set to increase prices on Boeing aircraft by an average of $4 million per plane. Boeing CEO, Kelly Ortberg, threatened to move some Boeing manufacturing to Mexico. Trump countered with a 200% tariff, and the band played on…

Anyone who has visited the Everett facility (and I have) recognizes the impracticality of moving even a minor part of manufacturing to Mexico.

So, here we have a clash of titans, with no obvious solution and little time left on the clock. Trump moves mostly by instinct and flattery, and he’s unhappy with Boeing’s cost overruns and unmet delivery schedule. When Trump’s unhappy, bad things happen.

My solution would be for the United States to nationalize Boeing.

Among the practical benefits of nationalization are stability, mission-driven governance that focuses on national security and public interest, rather than shareholder returns. Full government oversight could solidify domestic production, keep skilled jobs in the U.S. and reduce dependency on foreign suppliers. Mismanagement might be easier to address under direct government control, while Congress and federal auditors could enforce tighter transparency and cost discipline. Finally, the government could make long-term R&D investments (e.g., hypersonics, green aviation) without needing short-term profits.

The financial benefits would include giving a major airline on the brink of bankruptcy a clean balance sheet, while keeping and enhancing its core engineering talent. Avoiding cost overruns on government contracts as well. Boeing has routinely overrun budgets on fixed-price contracts like the KC-46 and Air Force One. Nationalization could allow the government to internalize these costs upfront and reduce overhead/profit margins, as well as eliminating the profit margin and administrative overhead associated with contracting that might well save billions over time.

Efficiencies in procurement, logistics, and project management might be achievable by consolidating functions. If managed efficiently, commercial profits could subsidize defense or infrastructure investment. And finally, Boeing's commercial aircraft (737, 787, etc.) could generate revenue for the U.S. Treasury, just as Airbus does for its European backers.

The existence of Airbus would squelch any national ownership complaints.

Time is short, national defense is a reason, and other options are scarce.

Eventually, if required or desired, Boeing could be re-privatized.