When Did We Decide that Shareholders Were Gods?

Easy answer. That was a Milton Friedman construct, who wrote that “there is one and only one social responsibility of business to use its resources and engage in activities designed to increase its profits.”

Uncle Miltie won a Nobel Prize for this and other contributions to economic nonsense that went on to bring various South American economies to their knees and infect Ronald Reagan’s easily infected mind. If you think that’s a liberal’s cheap shot at Reagan, I voted for the man—twice.

Friedman was not a bad man. He was simply wrong and wrong as hell on a very large international stage.

Economists are allowed to be wrong and from time to time many of them are. What they are not allowed is to have their wrong-headedness extend across forty years of political and economic history, driven by greed and greed’s choke-hold on reality.

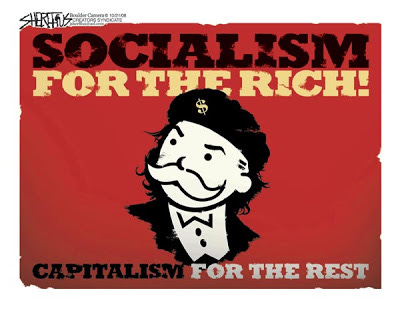

Facts still matter and the fact is that capitalism—a truly fine system, has turned on us and bared its teeth.

The capitalism I thrived under during my business boom-years of the 50s through 70s was based both on profit and social responsibility. You could also become rich at tax levels that reached 90%--millionaire rich, instead of the billionaire style that divides us so viciously. In the late 60s, J. Paul Getty and Howard Hughes topped the richest list at between $1 and $1.5 billion. Today, it's Jeff Bezos at $112 billion

It’s socially responsible to create great products and sell them at competitive prices, invest in the quality and care of your workforce and (by doing so) contribute to the national wealth.

Ford, General Electric, Baxter, Burroughs, Coca Cola, IBM and Sears Roebuck were all such companies. They were the ‘blue chip’ investments little old ladies depended upon in their retirement and they were dependable in that social contract. Investors in those days looked for long-term reliability, steady profits and growth.

Then something strange began to move capitalism slightly sideways. Milton Friedman’s wild and since disproved theories (the same that had destroyed South America by that time) took hold in the private mind and began to be marketed in the public mind.

If Nike can make shoes with Asian slave-labor to sell a $3 shoe for $100, it may be outrageously profitable. But it’s hardly socially responsible. Uncle Milton made it okay and, what-the-hell he’d won a Nobel. Americans no longer made shoes, but who cared? A little job loss, sure, but you don’t pay union wages, health and retirement benefits to Asians. Who the hell are they, anyway? Didn’t they bomb Pearl Harbor?

So Nike stock shot through the roof and it didn’t matter because shoemakers don’t buy stocks anyway. It’s just a small thing (except for those on the small end) and Nike suddenly had the marketing money to shove its swoosh down our throats. It was (and still is) very cool to wear the swoosh on your sports clothing. The swoosh brand became the thing and you and I actually paid Nike to wear their brand. A marketing success beyond all expectations.

Welcome to the Brave New World but hang onto your hat and wallet, you’re not going to like it much.

So if brand is the new flavor in town, how did we get capitalism on the menu?

Simple. Those dreary old investment advisors remarketed themselves as Goldman Sachs whiz-kids and (with a little lobbyist sleight-of-hand) banks were allowed to own investment divisions (as laws to prevent exactly that were lobbied out of existence) and the horses were out of the starting-gate. Stodgy old bankers became stock-market experts and not only promised riches, but would loan you the money, so shoemakers could become rich.

Overnight we became a nation addicted to gambling on the short-term instead of investing in value. 1929 was way too far in the past to remember and, besides that, these were the new rules in a new economy. Quarterly earnings were watched like a roulette-wheel and ‘blue-chip’ sounded like a new flavor of ice cream.

Universities immediately saw a drop in engineering degrees and a surge in MBAs. Who the hell wanted to get their hands dirty, when big dough was there for the taking?

Well it was there. Some took and some were taken. There were the sheep and those who sheared the sheep.

In the meantime, as actually making stuff fell out of fashion, wages dropped, jobs dried up (why here, when Asia was the place to go?) and the economic gulf began to widen. The social fabric upon which capitalism was built began to fray. Look no further than who got bailed out in tough times and who lost their homes. There will always be tough times, but we used to share them.

Tough times are the economics that balance out the good times. We simply changed the metrics of who will eat and who will serve.

Time was, when you or I made a poor investment we lost our money. No more. In this new economics when you made a bad investment you got bailed out and someone else lost their home and brought their kids home from college.

So, when did we decide that shareholders were gods?

We didn’t.

Nike (and others like them) kicked off to start the game, Milton Friedman refereed, investment banks were cheer-leaders and we were the beer and hot-dog audience, hollering for our team hoping to win.

Final score? A hundred-to-nothing and the bad guys won.

Think about that as you sift through today’s news. There have never been so many winners and losers.

The three largest wealth managers in the world are: UBS, $2.4 trillion; Bank of America Merrill Lynch, $1.1 trillion; Morgan Stanley, $1 trillion. For the understanding of un-understandable numbers, a trillion is a thousand billion dollars.

The three largest wealth mis-managers in America are you and I, the public: credit card debt, $1 trillion; student loans, $566 billion; auto loans, $314 billion.

Not hard at all to understand who will eat and who will serve.

Which side are you on?